CMS Work Opportunity Tax Credit Newsletter October 2020

In this issue:

- DOL Awards Grants to 12 States with WOTC Backlogs

- A Word on WOTC’s Renewal

- Official CMS Welcome to RSM Customers

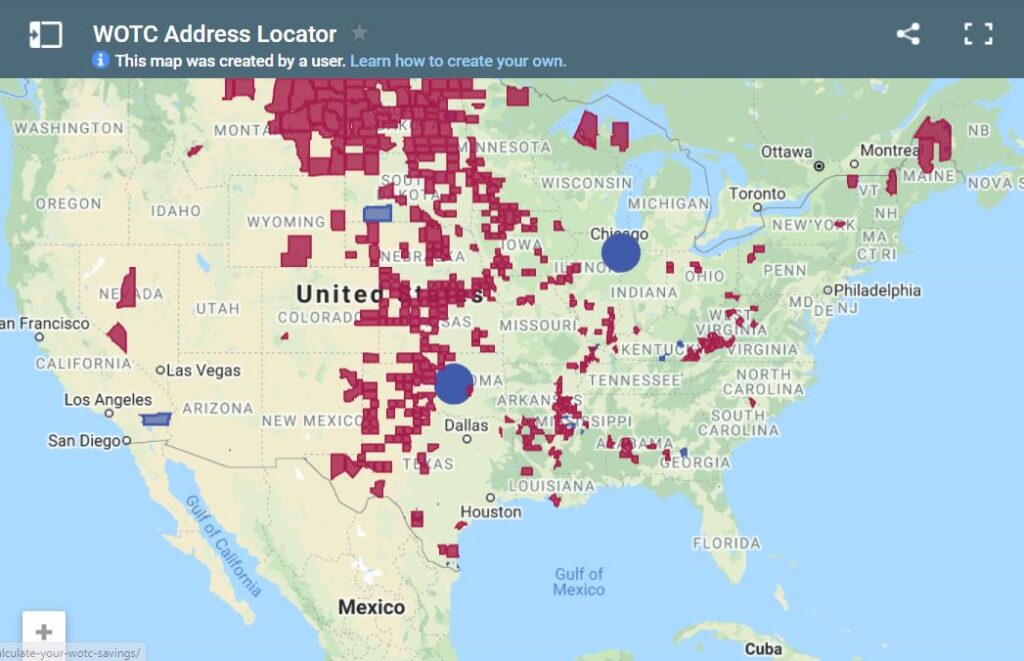

- Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

- Understanding WOTC’s Target Groups: Supplemental Security Income (SSI) Recipient

- Work Opportunity Tax Credit Statistics for Pennsylvania

- WOTC Questions: Is it worth it to do the WOTC?

- Switch To Paperless WOTC Screening

- #ICYMI

DOL Awards Grants to 12 States with WOTC Backlogs

The U.S. Department of Labor has announced the award of approximately $2,500,000 million in grants to help state workforce agencies streamline their business processes and systems to reduce the processing backlog, including the number of accumulated certification requests that employers have submitted and await processing.

A Word on WOTC’s Renewal

As you may be aware, the Work Opportunity Tax Credit is scheduled to expire on 12/31/2020. Law360 has recently reported that the renewal Of Tax Extenders (WOTC is part of this package) may have to wait until next year due to the ongoing focus on the Coronavirus pandemic. A potential expiration does not mean we stop processing WOTC. We encourage all employers to continue screening, within the 28 days of hire, so that you do not miss out on tax credits. Historically, if WOTC is allowed to expire, Congress will authorize retroactive screening which will cover the period of expiry.

Official Welcome to RSM Customers

RSM clients are in the process of transitioning over to CMS for WOTC Tax Credit screening. We are hosting a series of Zoom calls this month to make this a smooth transition for you. Don’t worry! You won’t see any interruption in service. RSM/CMS customers can see the Zoom schedule here.

Empowerment Zones, Enterprise Zones, Rural Renewal Counties Map

CMS has a helpful map of the United States Empowerment Zones, Enterprise Zones, or Rural Renewal Counties on our website. Use your mouse to zoom in or out to see your location(s). As stated above, the Federal Empowerment Zones have been renewed through the end of 2020.

Understanding WOTC’s Target Groups: Supplemental Security Income (SSI) Recipient

SSI Recipients by Age (via Center on Budget and Policy Priorities)

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #8 is the Supplemental Security Income (SSI) Recipient. An individual is a “qualified SSI recipient” if a month for which this person received SSI benefits is within 60 days of the date this person is hired. There is no age restriction on this category. California issued the most certificates for this target group in 2018 and 2019. SSI recipients accounted for 3.54% of all credits in 2019.

Work Opportunity Tax Credit Statistics for Pennsylvania

In 2019 the state of Pennsylvania issued 93,042 Work Opportunity Tax Credit certifications. Nationwide the keystone state issued 4.50% of WOTC Tax Credits in 2019. Pennsylvania was third overall for all TANF (short and long-term), and Ticket to Work credits. SNAP was Pennsylvania’s largest category at 62.70%.

WOTC Questions: Is it worth it to do the WOTC?

CMS Says: We think so. I can give you an example of some potential savings. A customer, an employer who has 250 employees who has 30% turnover in their industry hires 75-125 people each year. With a 15% qualifying rate they would typically see between $26,000 and $45,600 in tax credits.

Switch to Paperless WOTC Screening

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive