CMS Work Opportunity Tax Credit Newsletter June 2021

In this issue:

- Tips to Maximize WOTC Participation and Increase Savings

- Introduction to iRecruit with WOTC Screening

- Calculate Your Potential WOTC Tax Credits

- Veterans: How To Obtain a Copy of Your DD214 Form

- WOTC Wednesday: How Are The WOTC Tax Credits Calculated?

- Understanding WOTC’s Target Groups: Summer Youth Employee

- Work Opportunity Tax Credit Statistics for New York

- Switch To Paperless WOTC Screening in 2021

- #ICYMI

Tips to Maximize WOTC Participation and Increase Savings

With over 24 years of experience in Work Opportunity Tax Credit screening and processing, we would like to offer you some tips to make sure you get the maximum tax credit available in 2021. On average the United States spends $5 Billion each year on this program. How much did you receive?

Introduction to iRecruit with WOTC Screening

Join us for an iRecruit webinar. iRecruit is a full-featured applicant tracking software, with onboarding and Work Opportunity Tax Credits included. Dates throughout June.

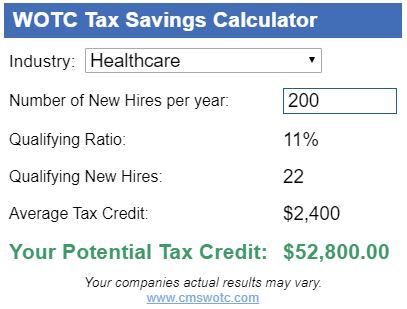

Calculate Your Potential WOTC Tax Credits

CMS has a calculator on our WOTC website that you can utilize to track your potential Work Opportunity Tax Credits. The calculator estimates your potential credit based on the industry you are in, and the number of new hires you may have.

Veterans: How To Obtain a Copy of Your DD214 Form

Qualified Veterans need to provide a copy of their Certificate of Release or Discharge from Active Duty form, known as a DD214.

WOTC Wednesday: How Are The WOTC Tax Credits Calculated?

CMS’s Brian Kelly answers your questions about the Work Opportunity Tax Credit in our new weekly video Q&A series #WOTCWednesday.

Other Recent WOTC Questions Answered:

- Are Salaried/Exempt Employees Eligible for WOTC?

- Can an employer make the WOTC forms required?

- Is WOTC Applicable to Seasonal Employees?

Understanding WOTC’s Target Groups: Summer Youth Employee

New hires who fall under one or more of WOTC’s Target Groups may make you eligible for a WOTC Tax Credit. Target Group #6 is the Summer Youth Employee. As the smallest qualifying category for WOTC, just 211 individuals were hired with certification from this group in 2020.

A “qualified summer youth employee” is one who:

- Is at least 16 years old, but under 18 on the date of hire or on May 1, whichever is later, AND

- Is only employed between May 1 and September 15 (was not employed prior to May 1) AND

- Resides in an Empowerment Zone (EZ), enterprise community or renewal community.

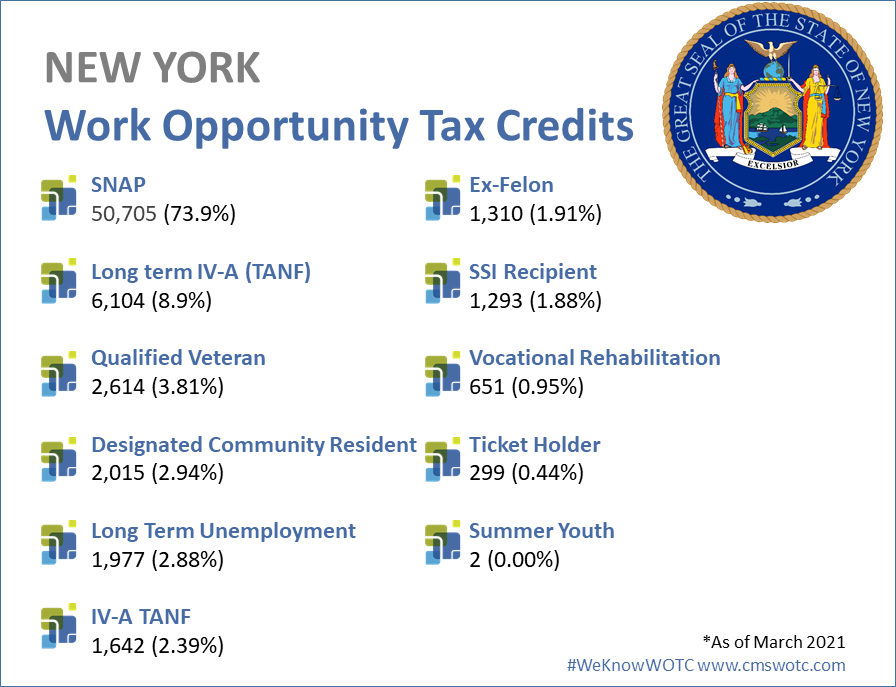

Work Opportunity Tax Credit Statistics for New York

In 2020 the state of New York issued 68,612 Work Opportunity Tax Credit certifications. Nationwide New York issued 4.23% of all WOTC Tax Credits in 2020. SNAP was New York’s highest tax credit category with 73.9% of certifications for that category.

Switch to Paperless WOTC Screening in 2021

CMS has been providing Work Opportunity Tax Credit screening services for over 20 years. We have helped save employers millions of dollars that can be reinvested back into their businesses. We highly encourage customers to take advantage of the online WOTC screening form that we developed or the call center, both of which provide several benefits to you.

#ICYMI

-

- Your WOTC Dashboard

- Increased Integration for WOTC Tax Credit to iRecruit, Applicant Tracking Software

- Work Opportunity Tax Credit By The Numbers 2020

- EEOC Issues Formal Opinion on the Work Opportunity Tax Credit

- Important Notice: URL Changes for Online WOTC Forms

- WOTC’s 28-Day Rule Explained

- WOTC’s Target Groups

- Calculate your WOTC Savings

#Follow CMS on Social Media

#WeKnowWOTC

The latest news on the Work Opportunity Tax Credit (WOTC) from Cost Management Services. Sign Up for the Work Opportunity Tax Credit (WOTC) Newsletter

Related: WOTC Newsletter Archive